- Products

-

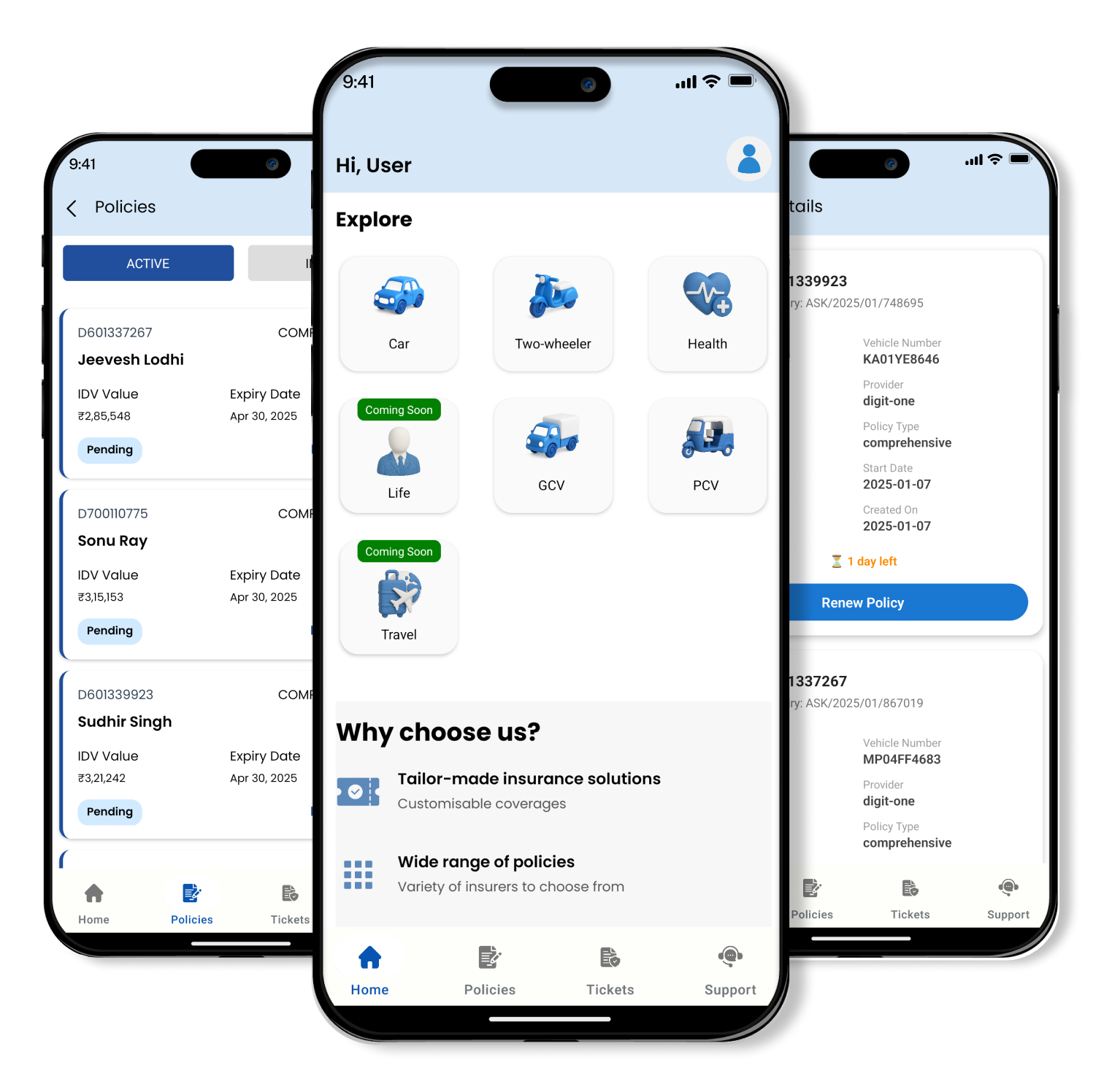

Motor Insurance

-

Non-Motor Insurance

-

Other Insurance

-

- Renew Your Policy

- File a Claim

- Endorsement

- Contact Us

- Become an Agent Login